HONG KONG, 29 October 2024 — The Philippine Consulate General in Hong Kong, in collaboration with FinTech Alliance PH and Fintech Philippines Association, successfully participated and showcased Philippine fintech startups under the Global Connects Forum in the Hong Kong FinTech Week (HKFTW) 2024 held on 28-29 October 2024 at the AsiaWorld-Expo, Hong Kong.

The Fintech Alliance PH, established in 2017, is one of the largest digital industry associations in the Philippines. It consists of over 100 corporate members that collectively account for more than 95% of the country’s digital retail financial transaction volume.

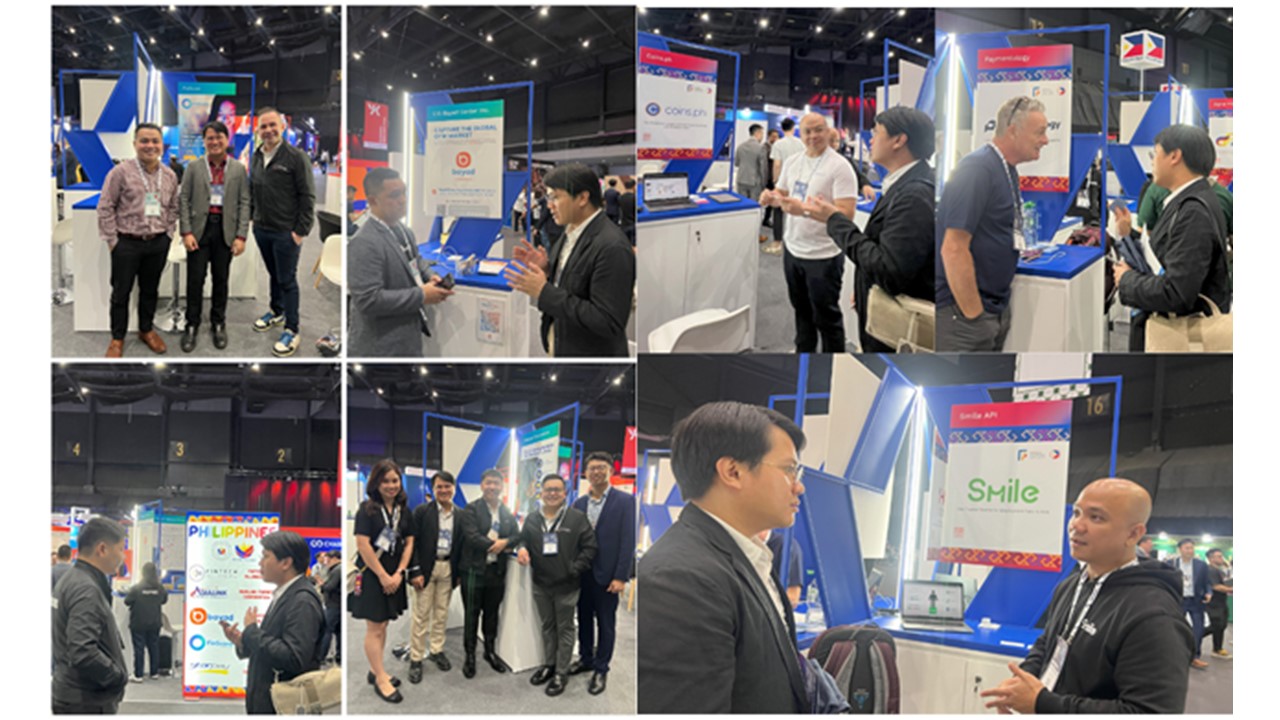

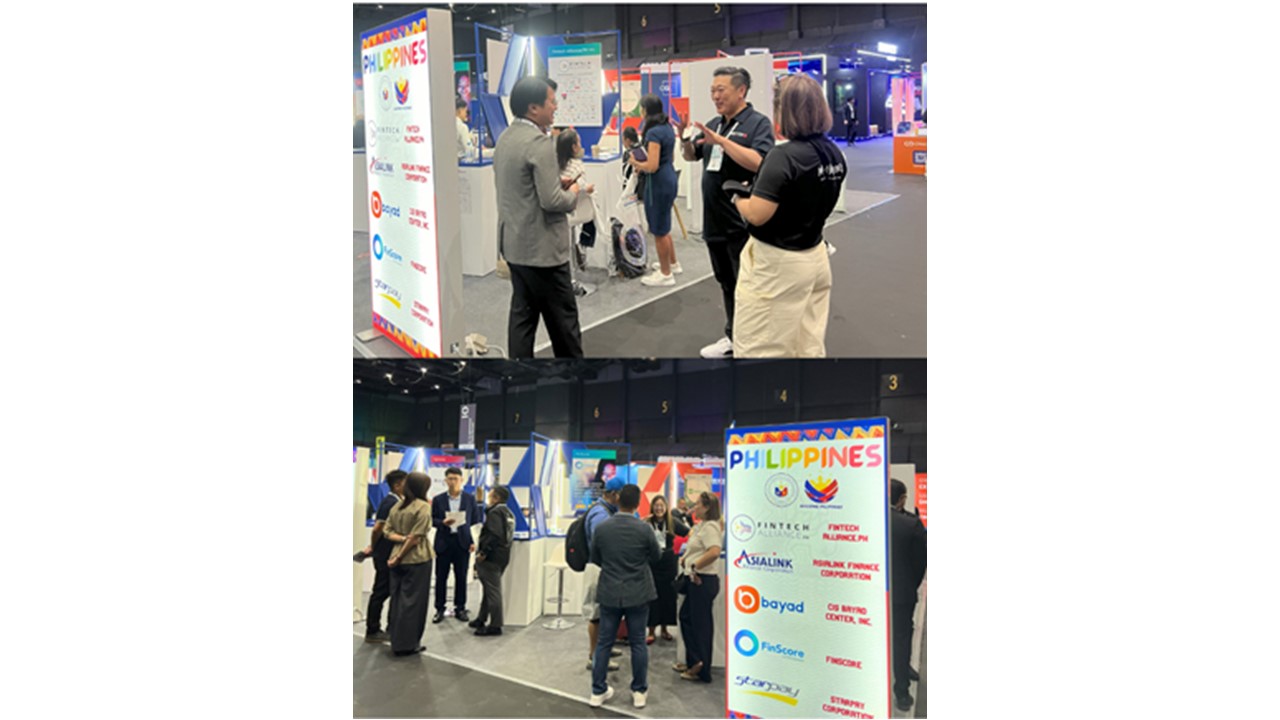

Fintech Alliance PH participated in HKFTW 2024 together with its members: Asialink Finance Corporation, an online financing/loan services firm; Bayad, formerly known as “Bayad Center”, a multi-channel payment platform; Finscore, an alternative credit scoring and fraud detection system based on telecommunications data; and Starpay, an e-money issuer and operator of payment systems.

Fintech Philippines Association also led the participation of Brankas, a provider of financial software and solutions; Coins.ph, a digital exchange and wallet for cryptocurrencies; Digital Pilipinas, an association of high-tech companies in the Philippines; Dragonpay, one of the pioneers in alternative online payments in the Philippines; HGC Global Communications, an information and communications technology (ICT) infrastructure operator and solutions provider; PaykoneQ, an innovative payment solutions provider; Paymentology, a global card issuer and processor serving the financial sector through its advanced and multi-cloud network; and Smile API, a provider of Know Your Customer (KYC) verification data portability for employment verification and credit data purposes.

Through the event, the participating Philippine fintech companies engaged more investors and partners and learned best practices and market insights from the participating global leaders in the industry.

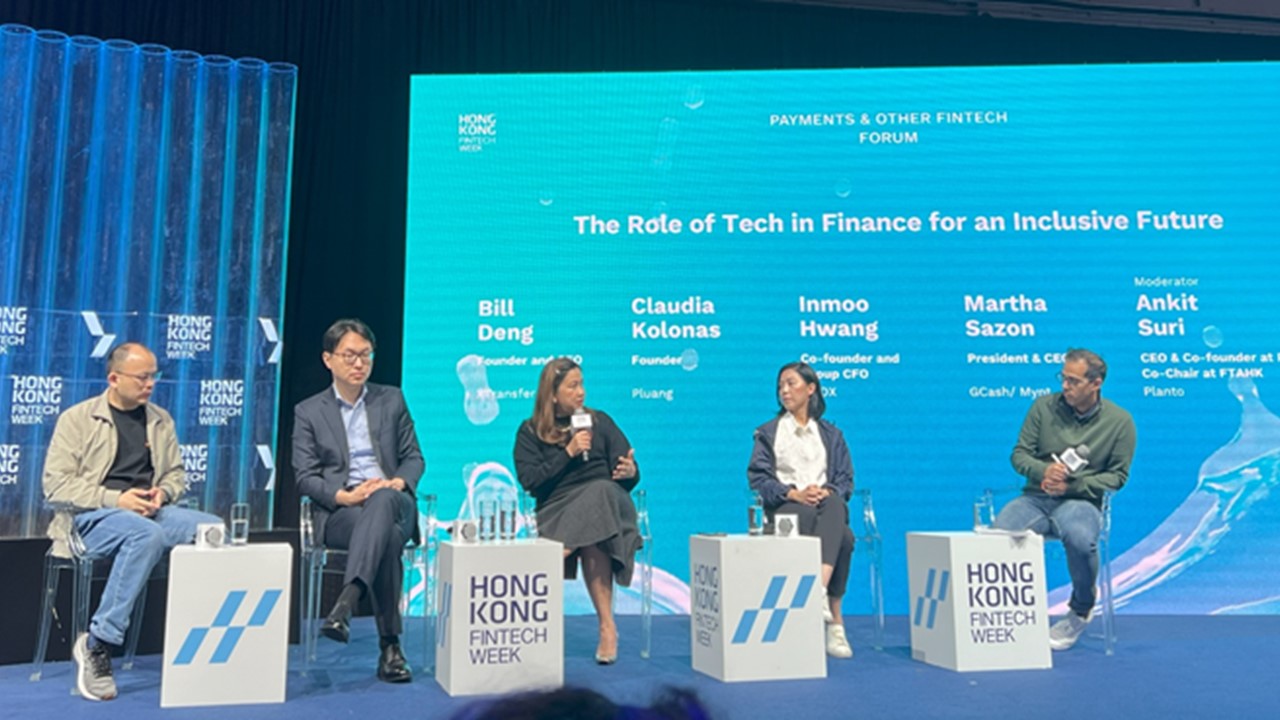

One of the featured speakers in HKFTW was Ms. Martha Sazon, President and Chief Executive Officer (CEO) of GCash/Mynt. Ms. Sazon discussed how GCash revolutionized digital payments in the Philippines. She presented the evolution of GCash from being a digital payment services provider in 2004 into a Superapp which provides services beyond money transfers and payments, including access to wealth products, savings, mutual funds, stock tradings, insurance, cryptocurrency, credit scoring, loans, and even job opportunities, among others. In line with GCash’s vision, “Finance for All”, Ms. Sazon shared how GCash continues to innovate its services to serve the unserved and underserved, driving financial inclusion for the Filipinos from all sectors, and growth to the Philippine digital economy.

During the courtesy visit of the FinTech Alliance PH delegation at the Consulate, Consul General Germinia Aguilar-Usudan recognized the significance and contribution of the fintech sector in shaping the government’s national strategy for financial inclusion and its push for the Philippines to become a digital hub. The Consul General also informed the Alliance that, “the Consulate is eager to explore more programs with the Alliance to enable the more than 220,000 Overseas Filipinos in Hong Kong to benefit from innovative digital products and services that are tailored specifically to their needs, beginning with initiatives focused on financial education, digital literacy and online remittance.”

The HKFTW 2024 is an annual flagship event organized by the Hong Kong Financial Services and the Treasury Bureau (FSTB), Invest Hong Kong (InvestHK) and FintechHK. Since its inception in 2016, HKFTW has gathered over 35,000 international leaders and attendees from all over the world, to exchange ideas and start meaningful business partnerships. It has evolved into a globally connected launchpad for innovation across fintech and emerging tech sectors. END

FinTech Alliance PH Chairman Lito Villanueva (3rd from bottom, right side) shares with Consul General Germinia V. Aguilar-Usudan (middle, left side) the association’s background, vision and mission in line with the Philippine Government’s thrust to become a digital hub.

FinTech Alliance PH Chairman Lito Villanueva (3rd from bottom, right side) shares with Consul General Germinia V. Aguilar-Usudan (middle, left side) the association’s background, vision and mission in line with the Philippine Government’s thrust to become a digital hub.

(from L-R) FinTech Alliance PH Secretariat Mary Mateo, FinScore Sales Director Dinecen Shairo Mateo, Vice Consul Allan Revote, FinScore Chief Commercial Officer Shaun Scheepers, FinTech Alliance PH Chairman Lito Villanueva, Consul General Germinia V. Aguilar-Usudan, Bayad President and CEO Lawrence Ferrer, Starpay Head of Strategy and Corporate Development Jan Chan, Starpay Product and Marketing Head Ryan Uy, and Bayad Chief Commercial Marketing Officer Dennis Gatuslao during the FinTech Alliance PH’s presentation of a copy of the Philippines FinTech Report 2024.

(from L-R) FinTech Alliance PH Secretariat Mary Mateo, FinScore Sales Director Dinecen Shairo Mateo, Vice Consul Allan Revote, FinScore Chief Commercial Officer Shaun Scheepers, FinTech Alliance PH Chairman Lito Villanueva, Consul General Germinia V. Aguilar-Usudan, Bayad President and CEO Lawrence Ferrer, Starpay Head of Strategy and Corporate Development Jan Chan, Starpay Product and Marketing Head Ryan Uy, and Bayad Chief Commercial Marketing Officer Dennis Gatuslao during the FinTech Alliance PH’s presentation of a copy of the Philippines FinTech Report 2024.

GCash/Mynt President & CEO Ms. Martha Sazon discusses how GCash uses technology in filling the gap and pushing for financial inclusivity to Filipinos in all walks of life.

GCash/Mynt President & CEO Ms. Martha Sazon discusses how GCash uses technology in filling the gap and pushing for financial inclusivity to Filipinos in all walks of life.

Vice Consul Allan Revote (7th from right) poses with the FinTech Alliance PH delegation

Vice Consul Allan Revote (7th from right) poses with the FinTech Alliance PH delegation

Vice Consul Allan Revote (5th from right) together with the FinTech Philippines Association

Vice Consul Allan Revote (5th from right) together with the FinTech Philippines Association

Vice Consul Allan Revote (right) with Ms. Susanna Chen, Fintech Programmes and Delegation Manager of Finoverse, appointed event organizer, during the Hong Kong FinTech Week 2024

Vice Consul Allan Revote (right) with Ms. Susanna Chen, Fintech Programmes and Delegation Manager of Finoverse, appointed event organizer, during the Hong Kong FinTech Week 2024

Vice Consul Allan Revote (2nd from right, lower right photo) converses with Philippine fintech companies participated in the Hong Kong FinTech Week 2024

Vice Consul Allan Revote (2nd from right, lower right photo) converses with Philippine fintech companies participated in the Hong Kong FinTech Week 2024

Representatives of Philippine FinTech companies confer with expo visitors the benefits and advantages of partnering with and investing in their respective companies

Representatives of Philippine FinTech companies confer with expo visitors the benefits and advantages of partnering with and investing in their respective companies

Expo visitors flocked at Asia-World Expo to engage with over 700 fintech exhibitors and gain insights from the Hong Kong FinTech Week 2024

Expo visitors flocked at Asia-World Expo to engage with over 700 fintech exhibitors and gain insights from the Hong Kong FinTech Week 2024