HONG KONG, 18 January 2025 - The Philippine Consulate General in Hong Kong participated in the 18th Asian Financial Forum (AFF) held from 13 to 14 January 2025 at the Hong Kong Convention and Exhibition Centre (HKCEC). The AFF is jointly organized by the Hong Kong Government and Hong Kong Trade Development Council (HKTDC). It is the first flagship financial event of the City in 2025.

Under the theme “Powering the Next Growth Engine,” the two-day Forum welcomed more than 140 influential leaders from government, finance and leading business communities as speakers, and over 3,600 participants from more than 50 countries all eager to witness the latest fintech advancements, emerging business strategies and expand their professional network.

The Consulate’s exhibitor booth invited AFF participants to “invest”, “create”, and “utilize” renewable energy sources available in the Philippines. Available investment opportunities in solar and wind power, hydropower, geothermal and biomass attracted the interest of a number of AFF participants who are eager to develop clean and sustainable sources of energy. The Consulate also invited foreign companies to locate in the Philippine industrial economic zones, and informed them of the investment opportunities in Clark through information materials provided by the Bases Conversion Development Authority (BCDA)

Speaking at the Plenary Session “Accelerating Growth through Innovation”, Philippine Securities and Exchange Commission (SEC) Commissioner Rogelio Quevedo emphasized the importance of digitalization to stimulate economic growth. While he acknowledged the Philippines’ robust economic growth at 5.8% last year, SEC Commissioner Quevedo underscored the Philippines' need to leapfrog by adopting innovations, particularly in technology, to further attract investments.

Consul General Germinia V. Aguilar-Usudan attended the Forum’s Opening Session wherein Hong Kong Chief Executive John Lee delivered a Keynote Speech emphasizing the strengths of Hong Kong’s competitiveness as an international business and financial center. He emphasized Hong Kong’s impressive global rankings, particularly as (1) the top territory in international bond issuance, (2) as the top territory in terms of business legislation and international trade, (3) fifth overall in the World Competitiveness Yearbook, and (4) as third in the most recent Global Financial Centres Index.

Some of the key highlights of AFF 2025 were discussions concerning sustainability and Environmental, Social and Governance (ESG) in reshaping global investments, regulatory impact of technology and Artificial Intelligence (AI), how financial strategies align with climate goals, global economic trends, regional opportunities between China and the ASEAN, and the financial landscape of the Middle East. The Forum also facilitated deal-making with over 270 investors and 560 projects, focusing on a wide spectrum of sectors such as fintech, environment, energy and environmental technology, food and agritech, health tech, and deep tech.

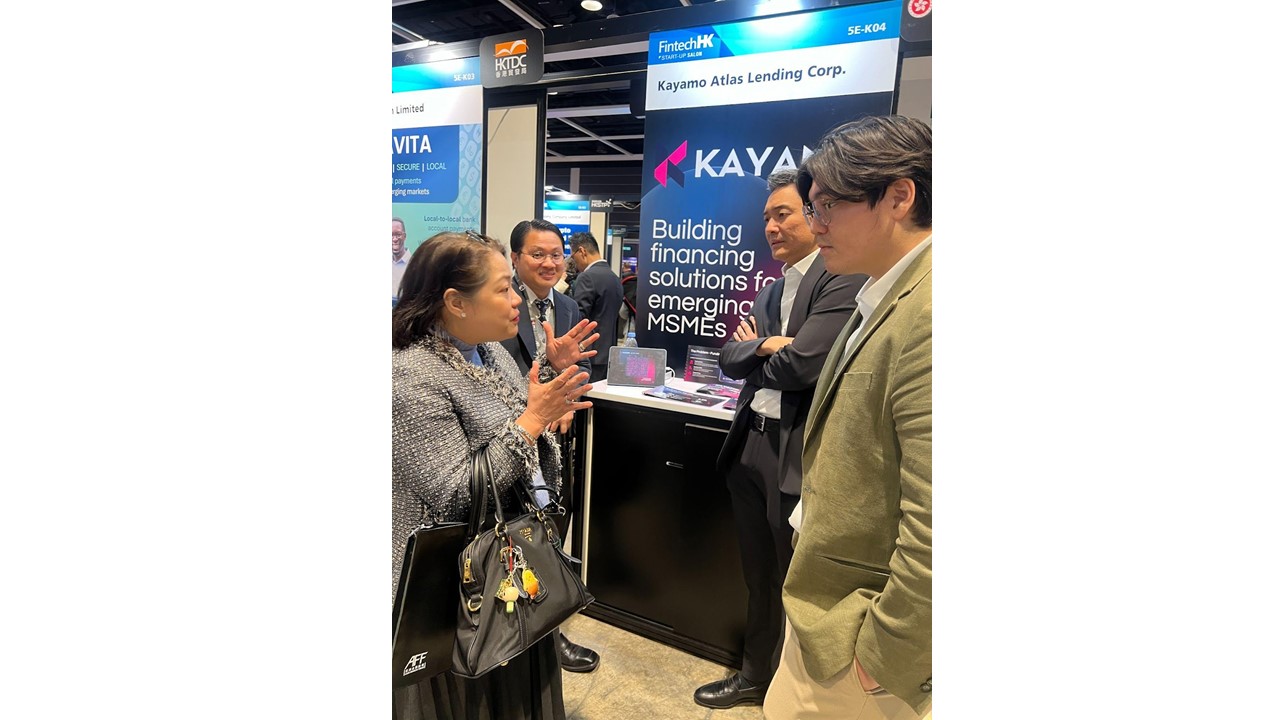

“Kayamo Atlas Lending Corp. (Kayamo),” a Hong Kong and Manila-based fintech company, joined as an exhibitor under the FintechHK Startup Salon. “Kayamo” is a digital lending platform that focuses on providing underserved micro and small businesses with fast, accessible working capital solutions. With the use of data analytics, alternative data sources and local market insights, “Kayamo” streamlines the loan application and approval process. “Kayamo” CEO and Founder Paolo Picazo was able to showcase their innovative projects and solutions in a special pitching session at the Innoventure Salon.

Meanwhile, Finvolution Philippines JuanHand Chief Executive Officer (CEO) Francisco Mauricio joined the participation of Finvolution Group as an exhibitor under the Fintech Showcase Zone. Finvolution Group, listed in the New York Stock Exchange since 2017, has been established as a leading fintech platform in China, Indonesia, and the Philippines. It provides diversified and innovative fintech services to connect individual borrowers with financial institutions

The AFF outcomes reflect a forward-looking approach to finance in Asia, emphasizing technological integration, sustainable practices, and international cooperation. END